Second mortgages. When your to start with mortgage doesn’t protect more than enough in the upfront money wanted, you can get a second mortgage. Fannie Mae sponsors a program called Group Seconds® that enables you to receive supplemental funding to deal with your down payment and closing charges from the municipality, non-gain, employer, or another very affordable housing program.

We strongly believe in the mission & work of the orgs we planned to guidance. They'll continue being our beneficiaries next yr. If you registered to participate in the 2020 race, your registration will transfer to 2021. pic.twitter.com/9wDMxrXyyN

Bankrate.com is an unbiased, advertising-supported publisher and comparison services. Bankrate is compensated in exchange for showcased placement of sponsored services and products, or your clicking on links posted on this website.

There won't be any down payment home loans, and also mortgages which you can get with a little down payment. Right here’s what you have to know about buying a home with a little down payment — and even no money down.

Steer clear of these seven mistakes when making a proposal over a house Understanding a real-estate agreement or invest in agreement What transpires when my real estate present is recognized? [Online video] What’s a contingency inside a housing order agreement? Finding sellers to pay your closing charges Be careful for these pitfalls with your real estate obtain agreement Counteroffer definition: Exactly what does it suggest when I obtain a counteroffer?

Yes. Actually, a brand new home should really fulfill USDA minimum amount standards far more conveniently than will an present home. Quite a few housing developments are going up in USDA-qualified locations, creating this loan a fantastic choice for new homes.

, this submit may possibly comprise references to products from our partners. Below’s an evidence for how we make money

Borrowers who don’t have all their closing costs paid for by the seller or usually require money to close the loan will need to prove they've got satisfactory assets. Two months bank statements will probably be needed.

Click below to apply for apply for usda home loan ohio

Interest prices may be greater: In some instances, you might have to pay for the next mortgage amount due to the fact a lender might watch you as a greater chance. The upper the curiosity fee, the upper the cost of the loan.

Indeed. To qualify, the borrower ought to at the moment Have a very USDA loan at present and will have to are in the home. The brand new loan is subject for the typical funding cost and annual cost, much like order loans.

Inquiries and responses must be property or room similar. By far the most useful contributions are detailed and assist others make far better selections.

Chenoa not simply offers down payments for borrowers across the country but What's more, it income from earning the loans by charging over-sector costs and costs.

To view proper prices and occupancy information and facts, be sure to insert the quantity of youngsters with your group and their ages to your quest. Cot and additional mattress policies

No money down loans appeared to get vanished during the housing bust, but USDA loans remained offered all over that time and are still currently available. The rising attractiveness in the USDA loan has proven that zero-down loans are still in high demand from customers.

You could have a better interest charge. Mortgages with minimal down payments frequently have an increased perceived danger. That’s why your lender may provide you with a bigger charge to assist lower it. This is predicated on anything known as danger-primarily based pricing.

This info may be made use of to deliver promotion on our Web-sites and offline (as an example, by telephone, electronic mail and direct mail) which is tailored to meet precise interests you will have.

For handier people, “sweat fairness†is an alternative choice. This just one will allow the customer to pay for their down payment by using advancements to the residence. Such as, if their do the job increases the home’s worth by 3%, they get credit score for any three% down payment—as long as an appraiser confirms the worth.

Some lenders have raised their minimum amount credit rating scores generally, or a minimum of to qualify for more preferential curiosity fees and mortgage phrases.

Like almost everything, the USDA loan program has its downsides along with all of the positives that come with it.

USDA presents among the few true a hundred% to start with mortgage solutions, meaning a purchaser may buy with no down payment.

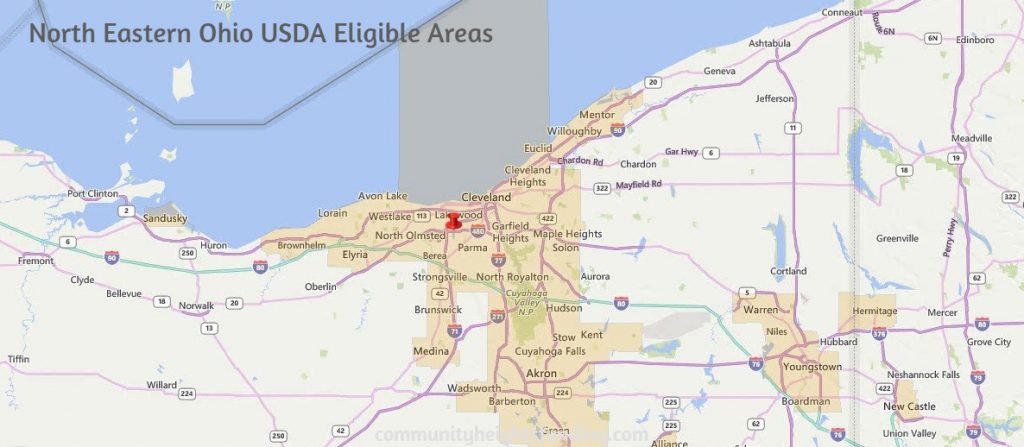

USDA Eligible Map In Ohio Region

Our proficient mortgage specialists will allow you to evaluate your options and guide you through the purchase system.

Created to enable buyers make self-assured choices on the internet, this website incorporates information regarding an array of products and services. Sure information, which includes although not limited to prices and Exclusive delivers, are provided to us straight from our companions and they are dynamic and matter to change Anytime without prior see.

An experienced mortgage loan officer is simply a cellphone get in touch with or e-mail away, with responses for just about any home-buying question.

In case you’ve these initial service prerequisites, you’re very likely eligible to get a VA Loan Certification of Eligibility and might also get Take note of the additional mortgage-similar guidelines.

mortgage loans is critical. Receiving the suitable mortgage for your personal condition may have a large influence on your All round fiscal situation and will help you make the home of one's goals an affordable actuality.

On top of that, you could possibly make use of a government or nonprofit program to get enable with your down payment or other upfront fees.

Simply how much down payment do you want for your house? How to obtain a house with $0 down in 2020: First time buyer How to save for the house: The whole tutorial Purchasing a house without many hard cash Down payment items: How to present and get a hard cash down payment reward for just a home Earnest money Look at, down payment and shutting expenditures: When are they owing?

USDA home loans need a least credit rating score of 640 to be approved through the automatic system. Applicants with lower credit history scores (600-640) can however be approved by way of manual underwriting, but It will likely be more hassle and very little is check here guarenteed. See additional usda loan credit score recommendations.